CNO Financial Group trades at $43.54 per share and has stayed right on track with the overall market, gaining 14% over the last six months. At the same time, the S&P 500 has returned 12.7%.

Is there a buying opportunity in CNO Financial Group, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is CNO Financial Group Not Exciting?

We're cautious about CNO Financial Group. Here are three reasons why CNO doesn't excite us and a stock we'd rather own.

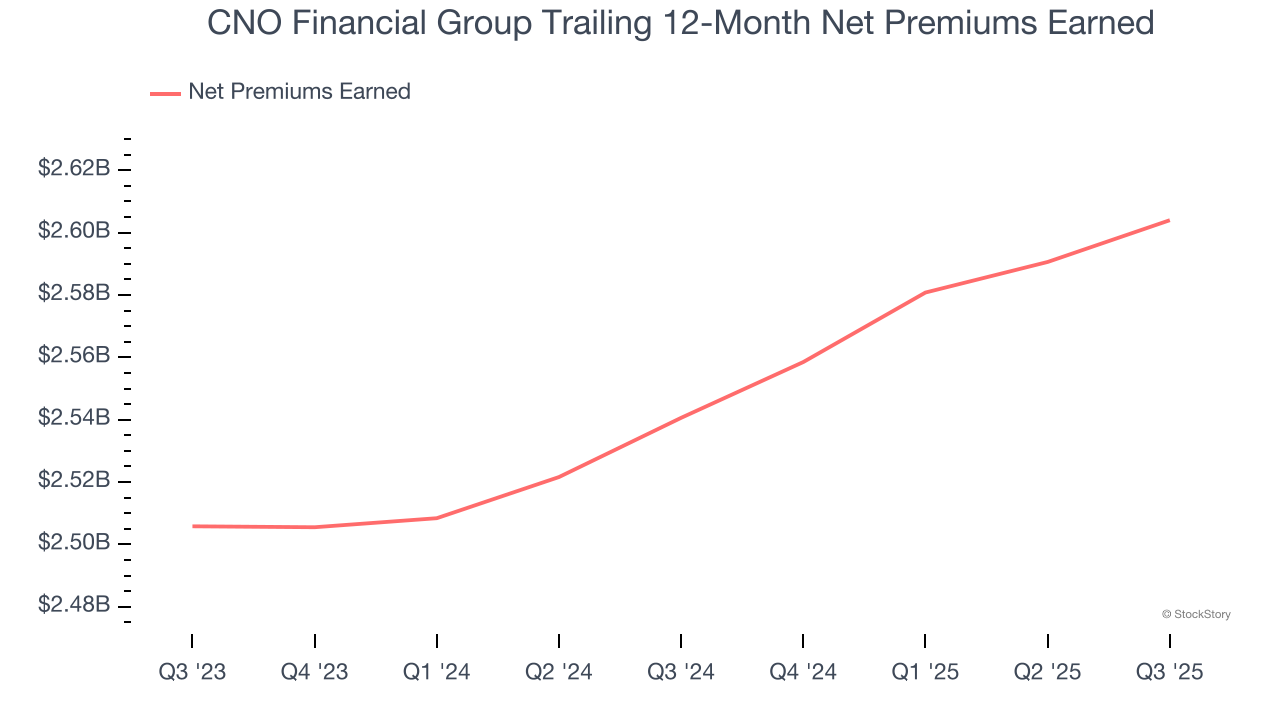

1. Net Premiums Earned Hit a Plateau

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

CNO Financial Group’s net premiums earned was flat over the last five years, much worse than the broader insurance industry and in line with its total revenue.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect CNO Financial Group’s revenue to rise by 3.8%, close to its 3.8% annualized growth for the past two years. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

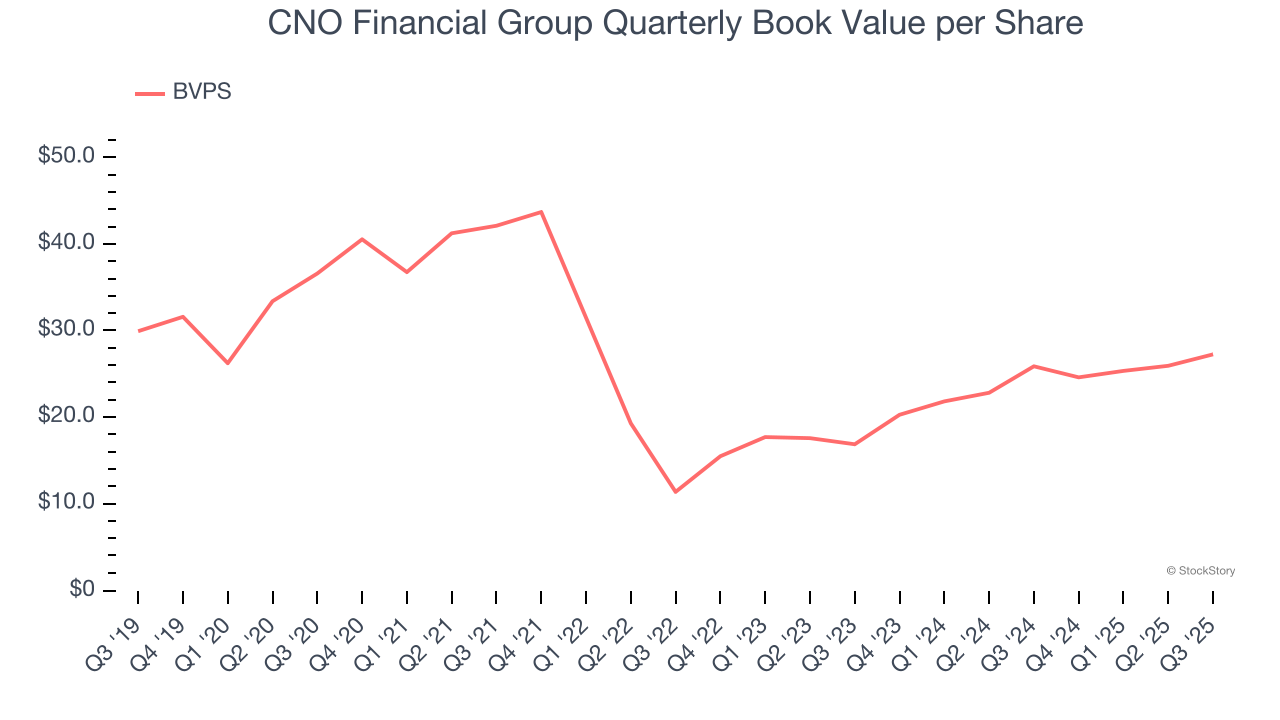

3. Growing BVPS Reflects Strong Asset Base

For insurers, book value per share (BVPS) is a vital measure of financial health, representing the total assets available to shareholders after accounting for all liabilities, including policyholder reserves and claims obligations.

Although CNO Financial Group’s BVPS declined at a 5.7% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at an incredible 27.1% annual clip (from $16.85 to $27.24 per share).

Final Judgment

CNO Financial Group’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.5× forward P/B (or $43.54 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of CNO Financial Group

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.