Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Employment data reveals a critical shift: Education and Health Services are now the sole drivers of U.S. job growth. As other private sectors stall or contract, these industries are single-handedly preventing a total labor market freeze.

Via Talk Markets · February 8, 2026

In this week's podcast, Michael provided an Elliott Wave Weekly Update for gold, silver, and platinum markets. He analyzed the recent price movements and potential future trends for each metal.

Via Talk Markets · February 8, 2026

Remember when AMC Entertainment was one of the hottest meme stocks on the planet?

Via Talk Markets · February 8, 2026

Nasdaq 100 stages huge comeback from Oversold to eye midpoint next (25.3K).

Via Talk Markets · February 8, 2026

The ongoing bull-bear duel is very well reflected in the candles that are showing up on the weekly, with three spinning tops over the last four weeks.

Via Talk Markets · February 8, 2026

Here's what I expect to see in upcoming economic data releases.

Via Talk Markets · February 7, 2026

BLS will release (w/delay) on Wednesday. Until then, we have ADP (which underwent benchmarking).

Via Talk Markets · February 7, 2026

The market has been range-bound for months.

Via Talk Markets · February 7, 2026

This week saw the start of de-risking/deleveraging in big tech.

Via Talk Markets · February 7, 2026

Rare earths, lithium, and graphite form the lifeblood of every smartphone, EV, and fighter jet. Here lies the true chokehold. China doesn't just mine these minerals; it refines and processes them for the world.

Via Talk Markets · February 7, 2026

Even Trump now admits he wants higher home prices, and it’s because older voters want their asset prices to go up forever.

Via Talk Markets · February 7, 2026

Consumer staples are where scared money hides while still calling itself invested. They're the last stop before cash. The real move comes when both sectors fall together. When staples can't hold.

Via Talk Markets · February 7, 2026

I view the market as lacking depth still, but on a slow, tricky mend.

Via Talk Markets · February 7, 2026

Silver could be in for a hard slog over the next couple of months and maybe a little bit beyond that before the next turn up begins.

Via Talk Markets · February 7, 2026

This is looking like an old time cycle high with the DJIA closing at an all time high unconfirmed by the broader indices.

Via Talk Markets · February 7, 2026

Silver has experienced several rallies over the past 60 years, often driven by supply shocks and macroeconomic stress.

Via Talk Markets · February 7, 2026

Volatility crept back into the market last week as the rout in the tech sector accelerated.

Via Talk Markets · February 7, 2026

The end-game of debt-debasement is already visible. The only thing that's still up in the air is our response.

Via Talk Markets · February 7, 2026

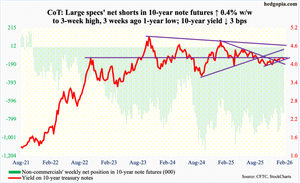

The Fed is becoming more relaxed about the US jobs market. Yet, this week's data makes that look complacent. And payroll numbers next week will be key. So, what's going on beneath the surface?

Via Talk Markets · February 7, 2026

Gamma, not fundamentals, drove Friday’s rally. The move higher was largely mechanical, as dealers adjusted hedges in a negative gamma regime.

Via Talk Markets · February 7, 2026

Caterpillar Inc. delivered an impressive performance in the fourth quarter of 2025, posting record revenues on higher volumes across segments. The industrial giant also returned to positive earnings growth. How should investors approach the stock?

Via Talk Markets · February 7, 2026

Robinhood stock climbed by 14% on Friday to $82.82, providing relief after a punishing decline that saw shares drop 46% from their all-time high of $152 on Oct. 9. The rebound came on heavy volume, with 53.9 million shares traded.

Via Talk Markets · February 7, 2026

Technology was the big market laggard again on Wednesday following disappointing earnings and more software anxiety. 7 of the 11 sector SPDRs were higher on the day, but the State Street Technology Select Sector SPDR Fund lost 2.8%.

Via Talk Markets · February 7, 2026

That was a seriously wild week. It seemed like the bears were going to absolutely take over the market, with an amazing crescendo seen late on Thursday as Bitcoin plunged to less than half its peak price. Friday saw the revenge of the bulls, however.

Via Talk Markets · February 7, 2026

Monetary policy stayed front and center this week as major central banks kept rates unchanged.

Via Talk Markets · February 7, 2026

This article examines the US trade balance by stripping out volatile gold movements to reveal underlying trends.

Via Talk Markets · February 6, 2026

Monday's trading session hammered home my approach to volatility -- and from a different angle. The S&P 500 had printed a 152-handle daily bar, the Nasdaq looked identical, and both were bleeding into the afternoon. Context forced another adaptation.

Via Talk Markets · February 7, 2026

If you’ve invested in US stocks as a Canadian, you’ve probably bumped into Canadian Depositary Receipts. They can be convenient, but convenience comes with a price tag. So, when do CDRs make sense—and when are you paying for something you don’t need?

Via Talk Markets · February 7, 2026

Bitcoin took a brutal hit in recent days, plunging to a low of $60,074 – a staggering drop of over 50% from its peak of $126,210. Yet, bulls remain unshaken, insisting a $1 million price tag is

Via Talk Markets · February 7, 2026

We have good news for consumers. First, PepsiCo announced it will slash prices by 15% on snack brands such as Lay's and Doritos. The second piece of good news is on the avocado front. Prices in Mexico have plunged down more than 19% from a year ago.

Via Talk Markets · February 7, 2026

There is a growing backlash against new data-center construction, and it’s slowing down the rollout of these facilities. And so, Musk’s long-term plan is to skip all that -- and take his data centers into space. And it’s not as crazy as it sounds.

Via Talk Markets · February 7, 2026

The oil markets had a green day today.

Via Talk Markets · February 6, 2026

We should expect rising layoffs going into 2026.

Via Talk Markets · February 6, 2026

Completely avoiding quantum computing equities at this stage may risk missing exposure to a multi-billion-dollar technology inflection over the next decade. Thus, here is a look at 2 stocks with significant quantum exposure to consider.

Via Talk Markets · February 7, 2026

AbbVie Inc. is a US-based biopharmaceutical company formed in 2013 as a spinoff from Abbott Laboratories. It’s a cutting-edge company with strong exposure to high-demand needs in immunology and oncology -- and it has a terrific pipeline.

Via Talk Markets · February 7, 2026

Here is a short look at the 10 largest companies by market capitalization as of Saturday, Feb. 7, 2026. Additionally, I have included the percentages of their gains on a year-to-date basis. Let's dive into the numbers.

Via Talk Markets · February 7, 2026

What has Wall Street been buzzing about this week? Here is a quick look at the top 5 Buy calls and the top 5 Sell calls made by Wall Street’s best analysts during the trading week of Feb. 2-6, 2026.

Via Talk Markets · February 7, 2026

Markets stumbled into February, a historically weak month. February tends to deliver modest returns, with average performance trailing the stronger gains typically seen in January and March.

Via Talk Markets · February 7, 2026

The U.S. dollar rose against the G10 currencies last week but the Australian and New Zealand dollars.

Via Talk Markets · February 7, 2026

For years now, corporate stock prices have been growing substantially faster than their free cash flows. In theory, this shouldn't be sustainable.

Via Talk Markets · February 7, 2026

This is not your grandma’s market volatility. This is what happens when politics and geopolitics become drivers of the entire market narrative instead of background influences.

Via Talk Markets · February 7, 2026

Ethereum price crashes 30% in seven days to $1,900, with technical analysis suggesting potential drops to $1,000-$1,400 range as selling pressure mounts.

Via Talk Markets · February 7, 2026

These chances don’t come often, so we should all hope it leads to better policy choices. The economy depends on it.

Via Talk Markets · February 7, 2026

Wall Street’s favourite macro assumption that inflation will cool “enough” to let the Federal Reserve cut rates on a predictable timetable faces a real stress test in the coming weeks.

Via Talk Markets · February 7, 2026

This week’s market action reinforced that leadership is no longer being driven by narrative alone but by the intersection of liquidity, capital intensity, and execution visibility.

Via Talk Markets · February 7, 2026

The S&P 3AI Indices represent our first AI-enhanced indices that use predictive modeling to drive stock selection.

Via Talk Markets · February 7, 2026

In the 30 years that the NFC won the Super Bowl, the S&P 500's average gain for the rest of the year was 9.6%, with positive returns 77% of the time.

Via Talk Markets · February 7, 2026

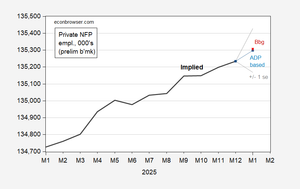

There will be two large revisions in the next two job reports that will hugely affect the picture on both job creation and the number of people employed.

Via Talk Markets · February 7, 2026

European energy provider EnBW announced a new long-term power purchase agreement (PPA) with Google, providing the tech giant with 100 MW of energy from a new offshore wind farm project in the German North Sea.

Via Talk Markets · February 7, 2026

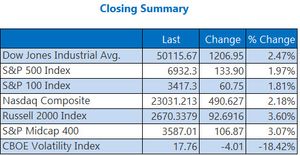

A powerful short-term rally on Friday, February 6, pushed the Dow Jones Industrial Average well above the 50,000 milestone and sparked a significant rebound in the S&P 500.

Via Talk Markets · February 7, 2026

The stock performance of Beyond Meat (BYND) has transitioned from a market leader to what analysts now classify as penny stock territory.

Via Talk Markets · February 7, 2026

Media coverage highlights growing local community pushbacks against data center developments, posing a slow-down risk to data center power demand growth, along with US power market tightness.

Via Talk Markets · February 7, 2026

With Amazon stock trading at its cheapest P/E valuation in the last 10 years, this post-earnings selloff could indeed be one of the rarer buying opportunities on the dip.

Via Talk Markets · February 6, 2026

In this video, Peter Schiff breaks down why “Dow 50,000” is headline theater. In real terms, the Dow is only about 10 ounces of gold, down from more than 40 ounces in 1999—a roughly 75% bear market measured in real money.

Via Talk Markets · February 6, 2026

In this week's video, we'll review the latest charts and data to help us answer the question: healthy rotation or a major topping pattern?

Via Talk Markets · February 6, 2026

Via Talk Markets · February 6, 2026

Nearly all Magnificent 7 members have reported Q4 2025 results, with Nvidia scheduled to finish the cycle on February 25, 2026.

Via Talk Markets · February 6, 2026

Tracey looked at three large-cap gold miners headquartered in South Africa, the United States, and Canada. The fundamentals look strong in the entire group, as gold has traded over $4000 an ounce in 2026.

Via Talk Markets · February 6, 2026

Amazon and Alphabet are increasingly functioning as both infrastructure providers and applied AI leaders, a rare combination that positions them at the center of one of the most significant technological shifts in decades.

Via Talk Markets · February 6, 2026

The Japanese yen slipped as traders positioned for Sunday’s snap election, with markets expecting Prime Minister Sanae Takaichi to extend her hold on power and keep a reflationary policy mix in place.

Via Talk Markets · February 6, 2026

This video provides professional context on why precious metals markets often experience

Via Talk Markets · February 6, 2026

In the Commitment of Traders data tied to COMEX and reported by the CFTC, banks appear within the Commercial category. Across full market cycles, that category remains weighted net short silver futures.

Via Talk Markets · February 6, 2026

With limited growth drivers and the AGLC revenue boost set to expire, upside appears modest, making the stock more of a steady income play than a growth opportunity.

Via Talk Markets · February 6, 2026

It was risk on all the way today, as stocks rallied sharply into the close.

Via Talk Markets · February 6, 2026

Arm's results highlighted a mixed picture, with royalty revenue surging 27% on adoption of advanced architectures like Armv9 and growing data center usage.

Via Talk Markets · February 6, 2026

Silver sold off hard, but the pullback is a “very sharp, but non-event” and a classic “midpoint stumble,” we've not reached the top.

Via Talk Markets · February 6, 2026

EUR/USD rebounds as risk-on sentiment weakens Dollar after brief two-day DXY rally.

Via Talk Markets · February 6, 2026

Margin debt as a percentage of market cap of the stock market has gone from 1.6% to 2.3% $1.23 trillion over the last three years.

Via Talk Markets · February 6, 2026

The Dow Jones Industrial Average is one of the preeminent U.S. equity barometers, with close to 130 years of live history.

Via Talk Markets · February 6, 2026

The S&P 500 just closed the week unchanged to the penny. Meanwhile the Nasdaq barely caught the lower edge of its expected move.

Via Talk Markets · February 6, 2026

The Dow snapped its three-week losing streak on Friday, tacking on more than 1,200 points to secure its best day since May and close at a new record high.

Via Talk Markets · February 6, 2026

Gold just soared to some of its most-overbought levels on record, climaxing its largest cyclical bull ever. That was followed by one of gold’s worst down days in history, formally slaying that monster bull.

Via Talk Markets · February 6, 2026

ConocoPhillips reported strong cash flow yesterday and said it would pay shareholders 45% of its operating cash flow. That makes COP stock look cheap.

Via Talk Markets · February 6, 2026

Rising rates, crowded software trades, and new AI competitors are compressing margins and breaking long-term trends across software and private credit.

Via Talk Markets · February 6, 2026